The Facts About Clark Wealth Partners Uncovered

Table of Contents5 Simple Techniques For Clark Wealth PartnersSee This Report on Clark Wealth PartnersNot known Details About Clark Wealth Partners How Clark Wealth Partners can Save You Time, Stress, and Money.The 10-Minute Rule for Clark Wealth PartnersEverything about Clark Wealth PartnersExcitement About Clark Wealth Partners

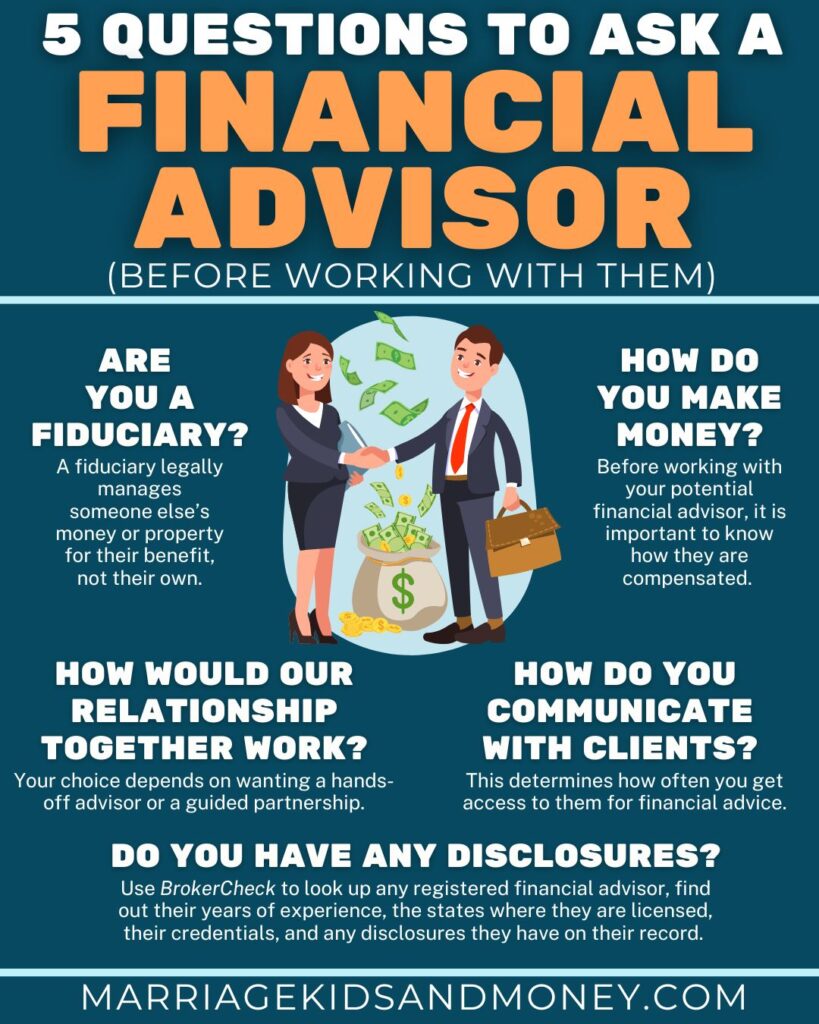

These are professionals who offer investment suggestions and are registered with the SEC or their state's securities regulatory authority. NSSAs can aid senior citizens choose regarding their Social Safety advantages. Financial consultants can likewise specialize, such as in student lendings, senior requirements, taxes, insurance policy and other elements of your finances. The certifications needed for these specialties can vary.Only financial experts whose classification needs a fiduciary dutylike qualified monetary planners, for instancecan claim the same. This difference additionally suggests that fiduciary and financial advisor charge structures vary too.

The Basic Principles Of Clark Wealth Partners

If they are fee-only, they're more most likely to be a fiduciary. Many credentials and designations need a fiduciary task.

Selecting a fiduciary will ensure you aren't guided towards certain financial investments due to the commission they provide - financial advisors illinois. With great deals of money on the line, you may want a monetary expert who is lawfully bound to utilize those funds meticulously and just in your best interests. Non-fiduciaries may advise investment products that are best for their pocketbooks and not your investing goals

The Definitive Guide for Clark Wealth Partners

Rise in savings the average house saw that worked with an economic advisor for 15 years or more compared to a comparable house without a financial advisor. "Extra on the Value of Financial Advisors," CIRANO Task Reports 2020rp-04, CIRANO.

Financial advice can be useful at transforming factors in your life. Like when you're beginning a family, being retrenched, preparing for retired life or managing an inheritance. When you consult with an adviser for the very first time, exercise what you desire to receive from the advice. Before they make any kind of recommendations, an advisor needs to put in the time to review what is very important to you.

The smart Trick of Clark Wealth Partners That Nobody is Talking About

Once you have actually accepted go in advance, your financial advisor will certainly prepare a monetary strategy for you. This is provided to you at another conference in a paper called a Statement of Suggestions (SOA). Ask the consultant to explain anything you do not understand. You ought to constantly feel right here comfortable with your consultant and their recommendations.

Urge that you are alerted of all deals, and that you obtain all document pertaining to the account. Your consultant may suggest a handled optional account (MDA) as a means of handling your investments. This includes authorizing an agreement (MDA contract) so they can acquire or sell financial investments without needing to consult you.

Things about Clark Wealth Partners

Prior to you purchase an MDA, compare the benefits to the prices and risks. To protect your money: Don't offer your consultant power of attorney. Never ever authorize an empty paper. Place a time limitation on any kind of authority you provide to deal investments in your place. Firmly insist all correspondence about your investments are sent to you, not simply your adviser.

This may take place during the meeting or electronically. When you go into or renew the continuous fee plan with your adviser, they must define exactly how to finish your connection with them. If you're relocating to a new consultant, you'll need to set up to move your financial records to them. If you need help, ask your adviser to discuss the process.

will retire over the next decade. To load their shoes, the country will need even more than 100,000 brand-new monetary advisors to get in the market. In their daily work, financial experts take care of both technological and creative jobs. U.S. News and Globe Report rated the role among the leading 20 Ideal Service Jobs.

9 Simple Techniques For Clark Wealth Partners

Helping people achieve their financial objectives is a financial advisor's main feature. They are additionally a small company proprietor, and a part of their time is dedicated to handling their branch workplace. As the leader of their technique, Edward Jones monetary consultants need the leadership skills to hire and handle personnel, in addition to the service acumen to create and carry out a business approach.

Financial experts spend time daily seeing or reading market news on television, online, or in profession magazines. Financial advisors with Edward Jones have the advantage of office research study teams that help them keep up to day on supply referrals, shared fund monitoring, and more. Spending is not a "collection it and neglect it" activity.

Financial consultants ought to set up time each week to satisfy brand-new individuals and capture up with the individuals in their ball. Edward Jones monetary experts are fortunate the home office does the hefty training for them.

All About Clark Wealth Partners

Edward Jones financial advisors are urged to seek added training to widen their understanding and abilities. It's likewise a good concept for monetary consultants to attend industry conferences.